No business can plan for every eventuality that will cross its path. This is why you and your insurance broker will be the resource you often need. They can give you peace of mind to sleep at night and help you take a few risks to grow your brand. Business interruption insurance is a topic that often comes up in conversation between brands and their insurance companies. Here’s all you need to know so you can make an informed decision for your business.

Contents

What is Business Interruption Insurance?

In short, this is how you protect your company from the impact that unplanned interruptions can have. It does relate to certain types of disruptions—not necessarily all of them.

Thanks to this insurance you can receive payouts, so loss of income doesn’t hit you as hard. This can be for a period of time while you wait for everything to return to normal, for your building to become accessible or for equipment to be replaced.

What Does it Cover?

You always need to discuss in detail what exactly is part of your policy, so don’t be afraid to ask your broker questions. The scenario this insurance applies to is basically that there’s a stop or pause in your normal operations and this results in you earning less or nothing. Such a policy will usually relate to a property or equipment that is required to earn income.

In general, you can expect a business interruption insurance policy to result in payouts if scenarios like these take place:

- The reason for the interruption is because of a natural disaster like a flood, which means you can’t use your premises.

- Third party role players cause your business to be affected and not able to function. One example of this is when authorities’ regulations limit access to your premises or require a shutdown.

- A covered event has caused damage of such a nature that you can’t continue operations for a time, as you need to initiate repairs.

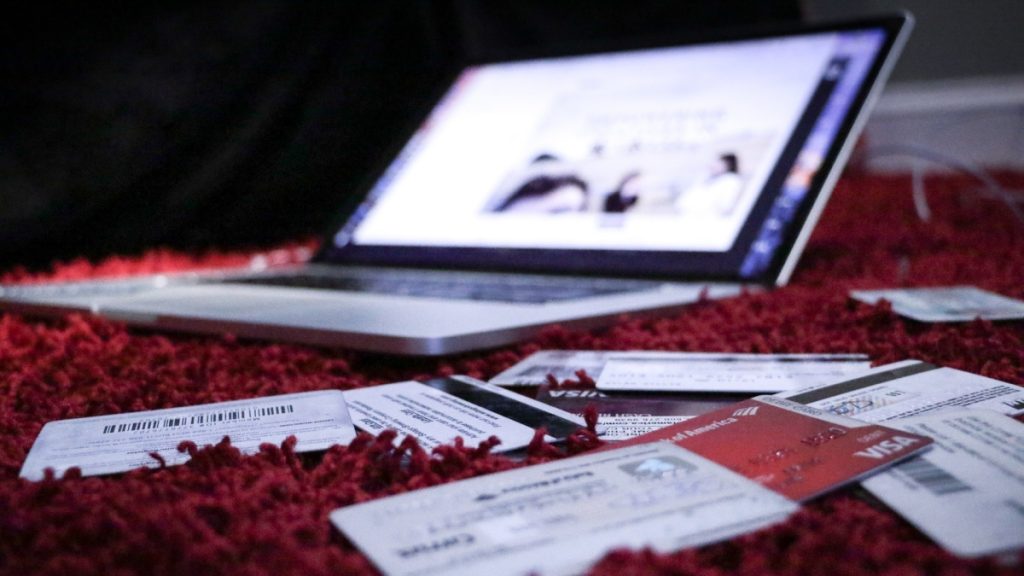

- There was theft and this results in you being unable to operate.

- Fire on the premises caused such damage that you can’t operate.

Payments to Expect

Once again, check your policy, but the types of payments businesses can expect are:

- Profits you expected to make in a certain period.

- The day-to-day expenses of your company, to keep it from falling into debt. This can range from utility costs to rent.

- Wages to employees.

- Insurance costs, so you don’t run the risk of not being covered for other problems that may arise in this time.

Who Should Get Business Interruption Insurance?

Many experts agree that this is insurance that almost no business should be without. Especially small businesses should discuss it with their brokers, as they have less cash and assets than major companies to see them through when there’s a break in earning income.

It’s especially important for establishments that operate at a certain venue or have assets like machines that determine their income. After all, if anything happens to these assets, you can’t make money anymore and may not have enough money available to see you through a few weeks or months of repairs and replacements.

Whether it’s a restaurant or small retail outlet, this is a sensible service to pay for.

How to Determine the Cover You Need

Your insurance broker will do an in-depth analysis of the cover you need and what you’re eligible for. This will determine what you’ll pay for the benefit. Features that can have an effect include:

- Risks associated with the geographical area your business is in

- The risk associated with your industry and niche

- Whether your business has certain vulnerabilities

- The size of your team

Remember, you have the freedom to choose how much cover you want, and this will affect the cost.

Tip: you can try and manage risk better, such as putting disaster recovery plans in place. Share this with your broker and they may reduce your fee.

Policies Have Limits

Having this backup plan will reduce your stress levels, but know that it won’t be the safe landing you’re after in each and every scenario. All policies apply to specific circumstances, clearly listed in your policy. Chances are that your cover won’t extend to scenarios like an epidemic and it may not pay out all types of damages, as something like broken glass could fall under a different type of cover.

Also, in order to get the payouts, you need to prove that the loss directly corelates with the premises or equipment mentioned in the policy.

Tip: payouts are based on financial records too, so make sure all income reflects in your statements.

Ask About the Waiting Period

You’ll sleep easier knowing your brand is protected, but did you discuss the timeline with your broker. A company could have a waiting period before cover is guaranteed, so ask about these stipulations and have alternative plans in place should something happen in the meantime.

Time to Talk to a Broker?

Your peace of mind and the future of your company depends on the choices you make today. Talking to your insurance company about business interruption cover could be one of the best decisions you make now.